Crank-Nicolson and Projected SOR for pricing american options

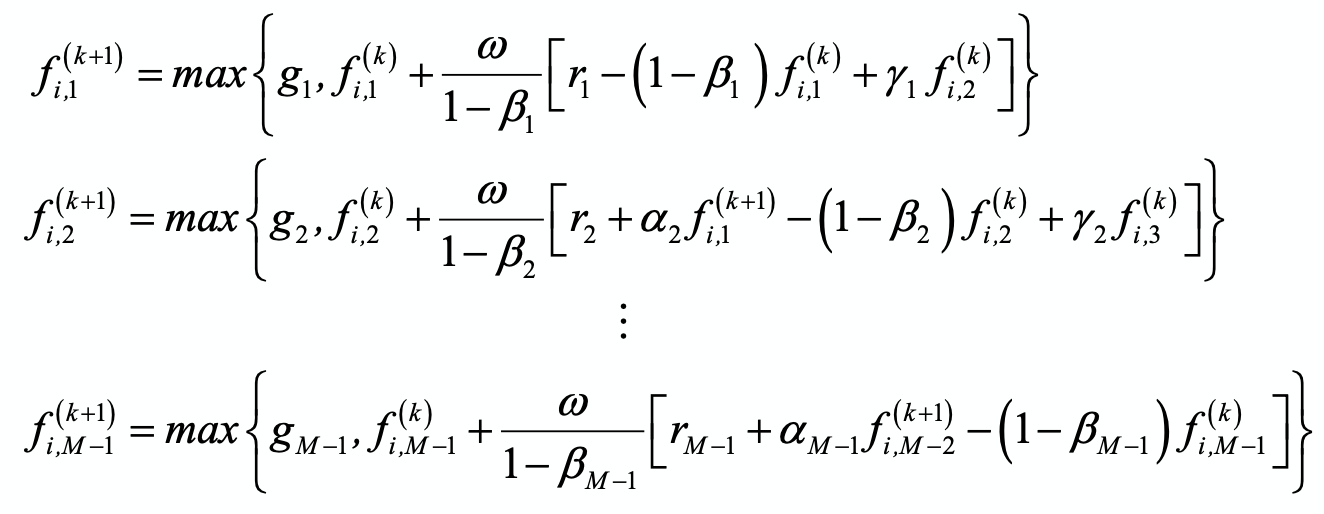

In this post I have elaborated on using Crank-Nicolson method to price a european option. It is more complicated to price american options using this method because they can be exercised any time before expiration time. To employ Crank-Nicolson for american options, linear systems in each layer can be solved using a numerical method called Projected SOR (Successive Overrelaxation). Using this method, for each time layer i, we have the iterative scheme:

Pyhon implementation

Suppose we have an american put option:

import numpy as np

T = 5/12

S_0 = 50

K = 50

sigma = 0.4

r = 0.1

price = 0

tol = 0.001

omega = 1.2

S_max = 100

N = 250

M = 100

dt = T / N

ds = S_max / M

I = np.arange(0, M+1)

J = np.arange(0, N+1)

old_val = np.zeros(M-1)

new_val = np.zeros(M-1)

# Boundary and final conditions

payoff = np.maximum(K - I[1:M] * ds, 0)

old_layer = payoff

bound_val = K * np.exp(-r * (N - J) * dt)

# Calculating elements of M

alpha = 0.25 * dt * (sigma**2 * (I**2) - r * I)

alpha = alpha[1:]

beta = -dt * 0.5 * (sigma**2 * (I**2) + r)

beta = beta[1:]

gamma = 0.25 * dt * (sigma**2 * (I**2) + r * I)

gamma = gamma[1:]

M2 = np.diag(1+beta[:M-1]) + np.diag(alpha[1:M-1], k=-1) + np.diag(gamma[:M-2], k=1)

b = np.zeros(M-1)

for j in range(N-1, -1, -1):

b[0] = alpha[0] * (bound_val[j] + bound_val[j+1])

rhs = M2 @ old_layer + b

old_val = old_layer

error = 1000000

while error > tol:

new_val[0] = np.maximum(payoff[0], old_val[0] + (omega/(1-beta[0]))*(rhs[0] - (1-beta[0])*old_val[0] + gamma[0] * old_val[1]))

for k in range(1, M-2):

new_val[k] = np.maximum(payoff[k], old_val[k] + (omega / (1 - beta[k])) * (

rhs[k] - (1 - beta[k]) * old_val[k] + alpha[k] * new_val[k-1] + gamma[k] * old_val[k+1]))

new_val[M-2] = np.maximum(payoff[M-2], old_val[M-2] + (omega / (1 - beta[M-2])) * (

rhs[M-2] - (1 - beta[M-2]) * old_val[M-2] + alpha[M-2] * new_val[M-3]))

error = np.linalg.norm(new_val - old_val)

old_val = new_val

old_layer = new_val

prices_t0 = np.concatenate(([bound_val[0]], old_layer, [0]))

idown = int(np.floor(S_0 / ds))

iup = int(np.ceil(S_0 / ds))

print(idown)

print(iup)

if idown == iup:

price = prices_t0[idown]

else:

price = prices_t0[idown] + ((iup - (S_0 / ds)) / (iup - idown)) * (prices_t0[iup] - prices_t0[idown])

print(price)

50

50

4.367132414514241